MEMPHIS, Tenn. — This week, discussions pick back up in Nashville, where a decision could determine how much those in Tennessee pay at the supermarket.

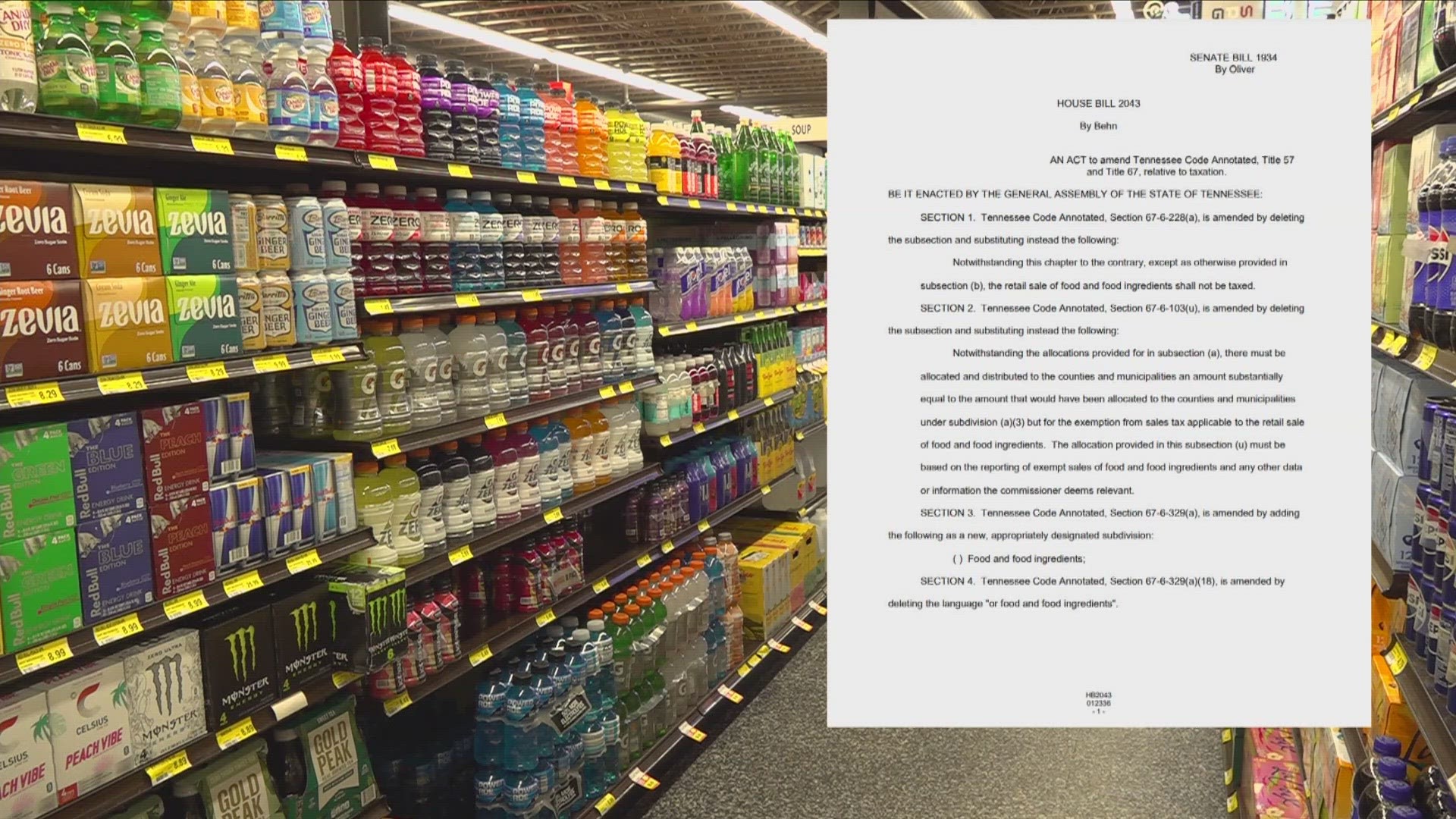

The state's grocery tax, a tax on food and food products, is on the chopping block as lawmakers debate whether or not to join the rest of the country in axing it. Oklahoma became the latest state to eliminate its grocery tax, making Tennessee only one of 12 who still have it.

“It’s an incredibly regressive tax," said Rep. Aftyn Behn.

The Nashville area lawmaker began championing HB 2043 after learning the hoops some families had to jump through to save money at the store. According to Help Advisor, the average Tennessee household spends $270.45 a week on groceries.

“I’ve received emails from numerous people who live on the border who travel to Kentucky to purchase their groceries," said the Representative.

If passed, the bill would eliminate the 4% grocery tax, and make up the estimated $700 million in revenue by instead taxing larger corporations in Tennessee 0.75% more.

"A study came out showing that 60% of corporations in the state of Tennessee don't pay what they owe in taxes," said Behn, “We could generate around $438 million via one mechanism, a tax reform mechanism that’s in our bill.”

As for the everyday Tennessean, this means a couple hundred dollars in extra pocket change. The average family in Tennessee save around $100 during the three-month grocery tax holiday in 2023. If applied year-round, families could reasonably save $400.

"The issue of reducing regressive taxes that are taxes on essentials like groceries has been talked about in every state including Tennessee over the years. Rarely is it more than talk and even less often does it get political support. The reason why is that sales taxes are a major revenue source for state and local governments," said Memphis economist John Gnuschke.

Since this restructuring would affect everyone, the Memphian said this would in turn have a greater impact on low-income families.

"Tennessee is not that unique on its dependence on sales taxes. It keeps a well balanced budget that grows as the state grows. But it still relies heavily on regressive taxes, and a reduction in sales taxes would be a good thing for rural and urban low income households," said Gnuschke.

Last week the bill received a negative recommendation in a Senate Subcommittee, but Behn said the bill will get a second chance in a few days. Lawmakers in the Tennessee House of Representatives will take up the issue Wednesday.

“It’s truly a proposal that shifts the tax burden from the least of these to those who should be paying more in taxes,” said Behn.