MEMPHIS, Tenn. — While communities in Tipton and McNairy Counties continue to recover from the devastating tornadoes on March 31, The U.S. Small Business Administration (SBA) announced ways residents in those and other disaster-declared counties from the storms can get federal assistance.

Residents in Hardeman, Haywood, Hardin, McNairy and Tipton Counties are included in the federal disaster declaration, meaning they are eligible for assistance through the SBA.

A spokesperson with the SBA said all homeowners in those counties are eligible for up to a $200,000 Home Disaster Loan at 2.3% interest to cover storm damage, as long as they are registered through FEMA.

Renters in these counties are also eligible for up to $40,000 to cover any personal belongings lost in the storms.

Business owners in the affected counties are also eligible for up to $2 million in the form of a Business Physical Disaster Loan at 4% interest. Non-profits are eligible for the same loan starting at 2.3% interest.

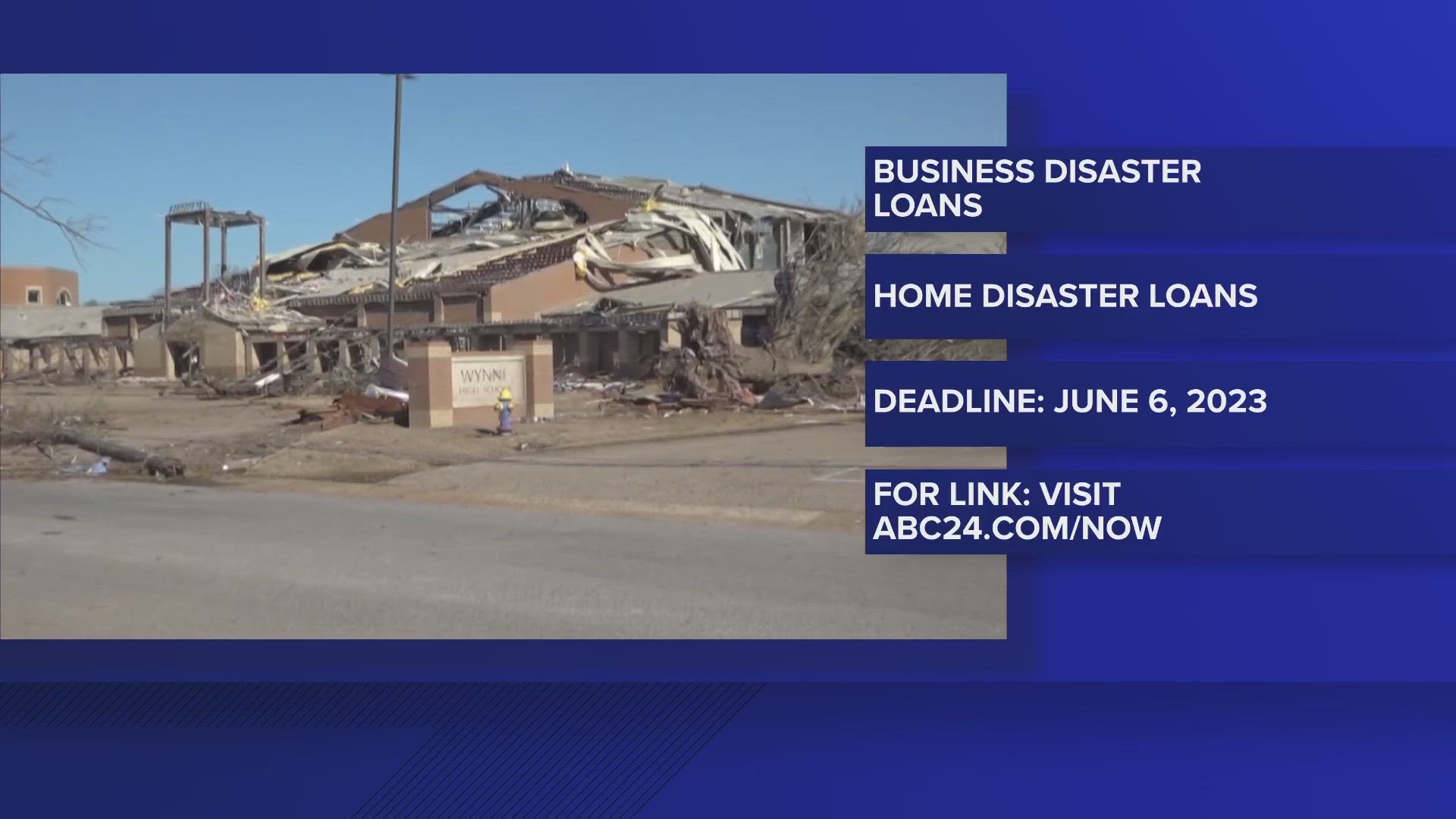

The filing deadline to return applications for physical property damage is June 6.

Residents in adjacent counties, including Shelby County, can also qualify for Economic Impact loans through the SBA, if they can prove they were economically impacted by the storm.

You can find more information and apply for each of these loans HERE under SBA declaration #17866.

The tornado outbreak the Mid-South experienced on March 31 was devastating to the communities of Wynne, Arkansas, and Covington, Tennessee. Significant damage was also reported in McNairy County, Tennessee.

A total of 14 tornadoes went touched down between Arkansas, Tennessee and Mississippi. Homes were destroyed, communities uprooted, and, tragically, lives were lost.