MEMPHIS, Tennessee — Rising prices are affecting all of us in our daily lives, especially Memphis area seniors with fixed costs each month.

For one Memphis couple and many other seniors, that means saving more, spending less and making tough choices.

"It's stressful. It's stressful, yes. You have to keep your focus at all times," Barbara Williams said.

On Saturday, Williams turns 77 but there's little celebrating these days for the newly retired senior on a fixed income.

"You can't forget that everything is really high now and you have to watch your spending," Williams added, who married her husband Ozell in January.

The couple isn't alone in navigating inflation - everything from food to fuel - while budgeting Social Security payments.

"Most seniors get their income at the beginning of the month, so what happens is near the end of the month, we have to really start managing," Williams said.

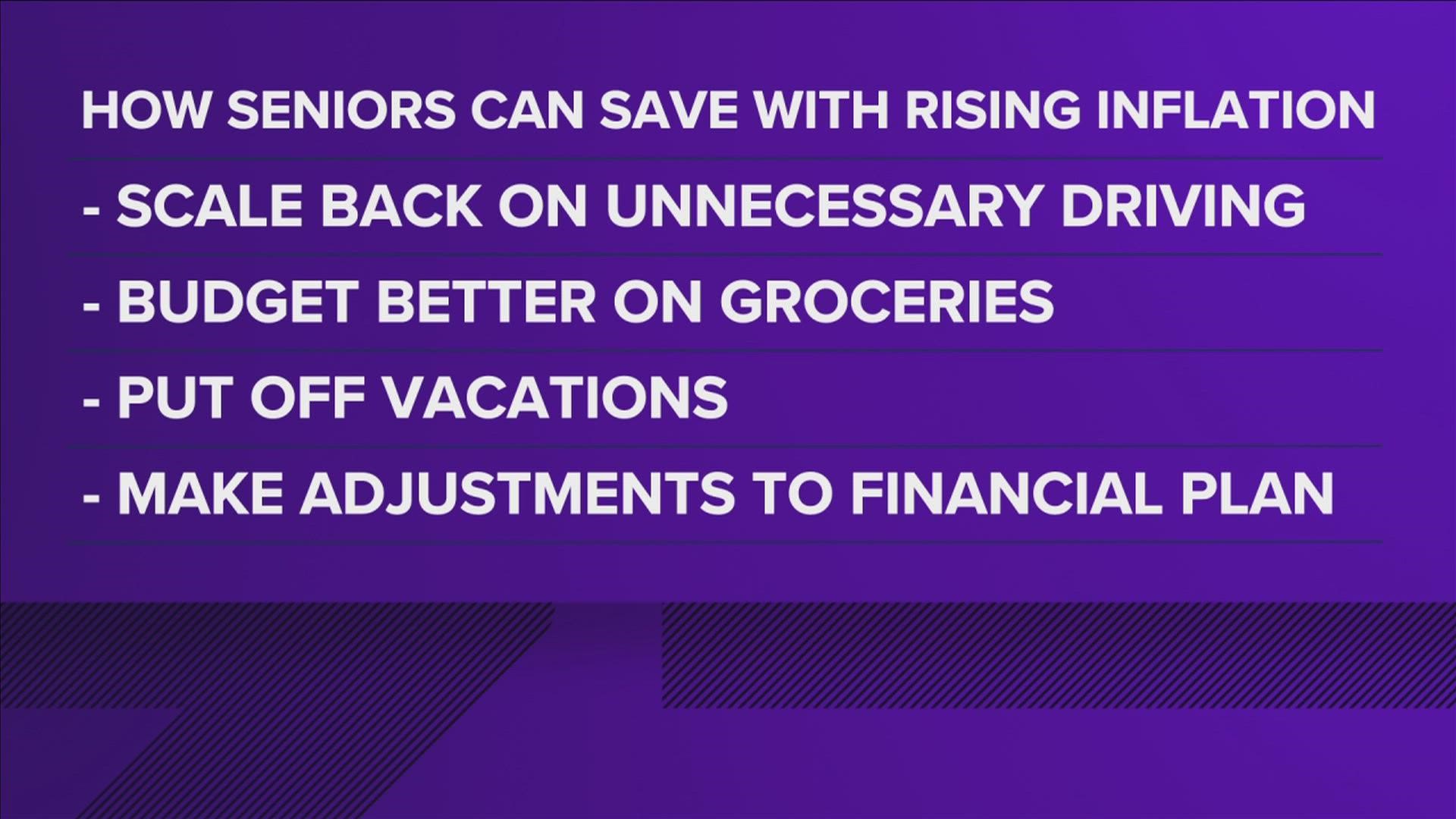

Financial planners suggest seniors can save if they scale back on unnecessary driving, budget better on groceries, put off some vacations, and make adjustments to their financial plan.

"I mean have you seen the price of meat?" Williams said. "So you eat less meat and more vegetables."

Williams worries if costs don't stabilize or go down in the near future, she and her husband may need to rely on the Commodity Supplemental Food Program run through the Shelby County Health Department.

"We haven't had it for a while, we've been doing alright, but now - on a fixed income - the commodities come in real handy for seniors," Williams said.

Social Security payments are adjusted for inflation for things such as gas prices but sometimes those adjustments aren't enough to offset higher prices for things such as health care.