MEMPHIS, Tenn. — A letter sent to Shelby County commissioners in late September from the Tennessee state Comptroller outlines what they say are years of discrepancies in the county's budget, which could cause future budgets to be rejected by the state.

"It’s time for it to come out to the light,” said Edmund Ford, Jr., Shelby County Commissioner.

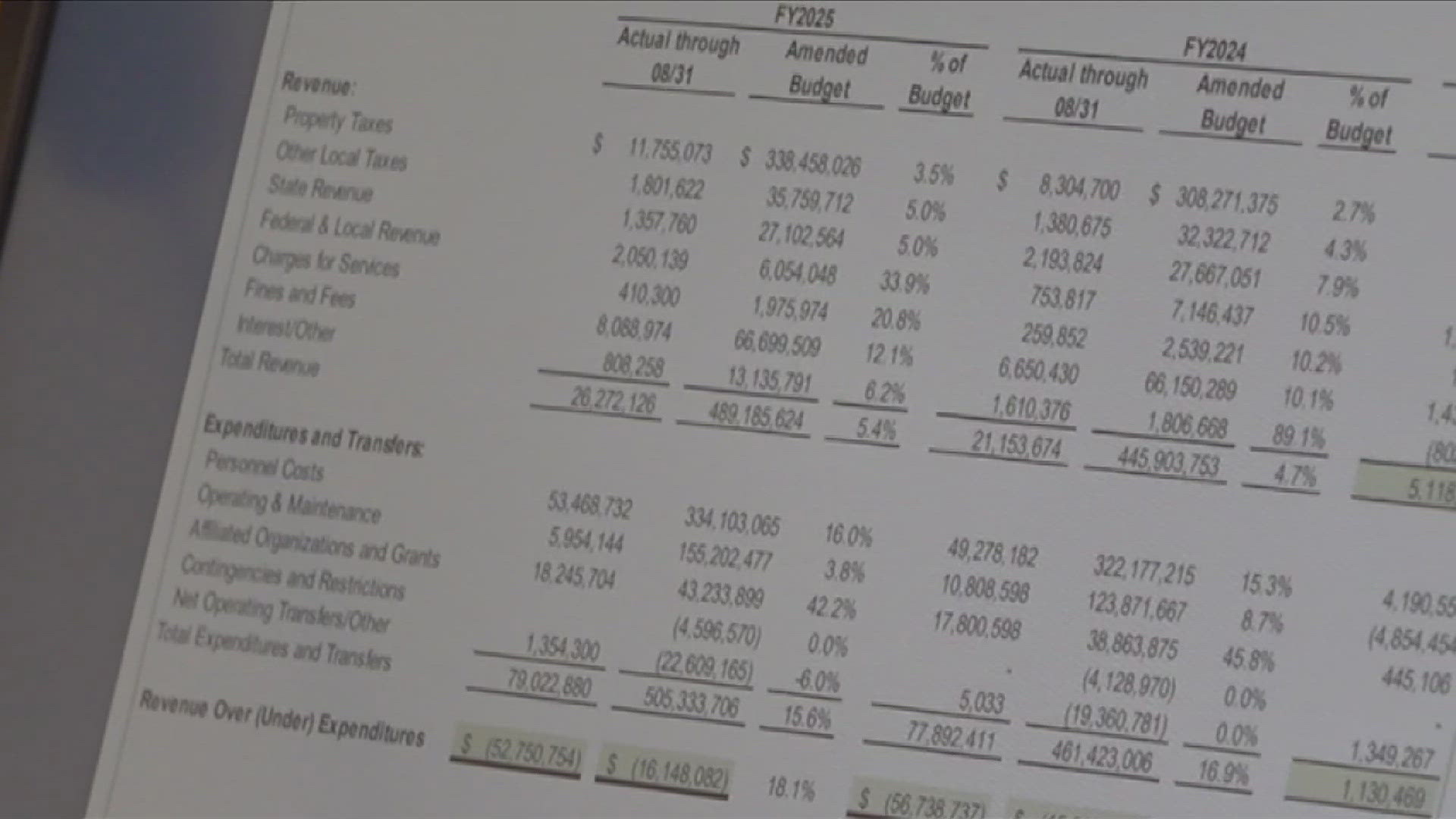

The letter, obtained by ABC24, outlined discrepancies in Shelby County budgets going back to fiscal year 2022, including incomplete budget submissions to the state.

"The submission was not presented in a manner that allowed for a clear and efficient review by our office," the letter said.

Shelby County commissioners told ABC24 they were under the impression the past four budgets had been approved, but the letter from the Comptroller's Office said those budgets were only conditionally approved, and require additional information for approval.

“The comptroller stated that we had significant structural imbalances, it also stated that we spent too much money that we budgeted, but then went over,” Ford said.

The Comptroller's Office said if the county does not properly submit next year's fiscal year 2026 budget, that budget would be rejected, meaning the state would not be able to appropriate funds for Shelby County programs and operations.

While Michael Thompson with the Shelby County Administration and Finance Department argued the budgets always got approved, commissioners quickly fired back. Letters from the comptrollers office noted those approvals were conditional after back and forth conversations with the county, and the issues continued for years.

“The county submitted incomplete materials in fiscal year 2022, for fiscal year 2023 for fiscal year 2024, for fiscal year 2025," said John Dunn, Comptroller Office Director of Communications. "Next year we’re not going to mess around.”

That means future school and infrastructure projects could see funding pulled if the county budget is rejected.

“We’re dealing with issues in textbooks, we’re dealing with issues in funding," said Towanna Murphy, MSCS Parent and School Board Member. "That messes with the infrastructure of the schools, it messes with the education and a variety of things in our city if it’s not approved. This time we have to make sure it’s squeaky clean.”

The Comptroller's Office outlined six points the Shelby County commission needs to include in future budgets for them to be approved:

- The name and email address for the County Mayor should be included in the cover letter.

- A detailed budget should be included for all funds that are included in the resolution, including school funds, these schedules should be at the line item level and be split up by department.

- For any operating fund ending the year with a cash balance below 15% (or if it meets any of the other criteria identified in the Budget Manual), a cash flow forecast must be provided. If a fund is budgeted to end the year with a negative fund balance, a written explanation for the negative balance should be included.

- Beginning cash and fund balances must be included for all funds, this can be completed in the budget summary schedule.

- Property and sales tax forecasts must be included.

- All detailed schedules should correspond to what was appropriated in the adopted resolution.

During the Commission Committee meeting Wednesday, several commissioners took the issue head on, beginning discussions to potentially start the budgeting process earlier in order to give the district more time to make sure everything is done correctly.

"If we’re not doing our part and we have a schedule that’s half baked, as it’s been the last two years, they can’t do their job,” Ford said.

Shortly after the budget issue came to light, ABC24 caught up with MSCS superintendent Marie Faegins, who told reporters the district would gladly do their part to help facilitate the budget process.

From what Dunn has seen, commissioners appear to be taking the issue seriously, and Dunn says the Comptrollers office is willing to do their part to keep a potential rejection from happening.

“We’ve also let the county know we’re willing to work with them before they ever submit anything to us, just it’s complete before they hit the send button,” Dunn said.

We've reached out to the Shelby County Commission for a statement and will update this story when they reply.