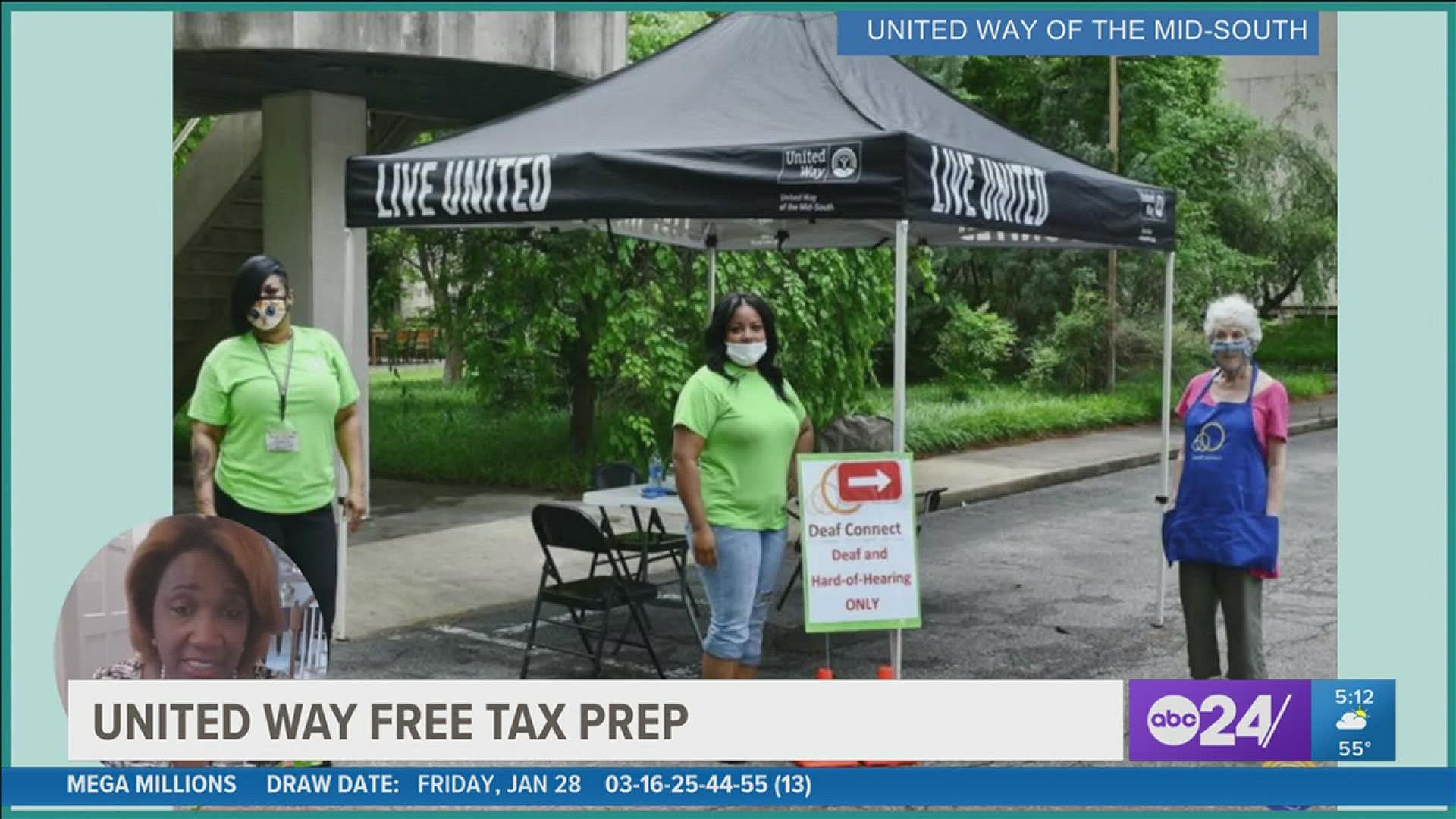

MEMPHIS, Tenn. — Filing your taxes might be a little tricky this year, but United Way of the Mid-South is helping families file for free.

In 2002, United Way of the Mid-South and the Internal Revenue Service started a coalition of local businesses, non-profits, and other partners to create the Free Tax Program. Households that made $58,000 or less last year qualify for the program.

Call 2-1-1 or 1-888-709-0630 for site operating hours and to find the nearest location.

This year, there are more than a dozen locations and mobile sites open across the Mid-South.

Here’s a list:

- United Way Plaza

1005 Tillman St., Memphis, TN 38112 - Lester Community Center

317 Tillman St., Memphis, TN 38112 - West Memphis Public Library

500 E. Broadway Blvd., West Memphis, AR 72301 - Frayser Free Tax Prep Super Site

3684 N. Watkins St., Memphis, TN 38127 - Hickory Ridge Mall VITA Site

6075 Winchester Rd., Memphis, TN 38115 - Highland Heights Church

3587 Macon Road, Memphis, TN 38115 - MR Dye Public Library

2885 Goodman Rd., Horn Lake, MS 38637 - Memphis Campus VITA Site (IRS Employees ONLY)

5333 Getwell Rd., Stop 14, Memphis, TN 38118 - Oasis of Hope-Bickford Community Center

233 Henry St., Memphis, TN 38107 - RC Irwin Public Library

1285 Kenny Hill Dr., Tunica, MS 38676 - Raleigh Free Tax Prep Super Site

3452 Austin Peay Hwy., Memphis, TN 38128 - Senior Enrichment Center

12615 South Main St., Somerville, TN 38068 - South Branch Library

1929 S. Third St., Memphis, TN 38109 - Southland Mall Super Site

1291 Shelby Drive, Memphis, TN 38116 - The Hill Hernando Baptist Church

1775 Memphis St., Suite B, Hernando, MS 38632 - The New Olive Worship Center

10000 Woodland Hills Dr., Memphis, TN 38108 - University of Memphis Law School

1 N. Front St., Memphis, TN 38103 - Word of Life SDA Church

1215 Floyd Ave., Memphis, TN 38127

COVID-19 Safety

This year, United Way of the Mid-South is Everyone must wear a mask and practice social distancing. Taxpayers must drop off their information.

On arrival, the taxpayer will sign the Customer Sign-In sheet at the Intake table and take one of the large tax return envelopes.

The IRS certified Screener will review the taxpayer’s intake forms and documents, then return the originals to the taxpayer.

It will take approximately 24-72 hours to prepare the tax return. The taxpayer will be called or notified to sign and complete the return.

What to bring

- Photo I.D.

- Social Security cards and birth dates, if filing joint or claiming dependents, the spouse and dependents Social Security cards must be provided as well

- All W-2’s, 1099’s, and information on other income

- Information for all deductions/credits

- Total paid to daycare and their tax I.D. number

- Health Insurance 1095 form

- Account information for direct deposit

- If married filing joint, both spouses must be present

The free service is available until April 15, 2022. To learn more, click here.