MEMPHIS, Tenn. — A new tax cut is making room for Tennessee families and business owners to save money.

Gov. Bill Lee signed the Tennessee Works Tax Act on Thursday, May 11, and the new legislation is the largest tax cut the state has ever seen, totaling $400 million in savings.

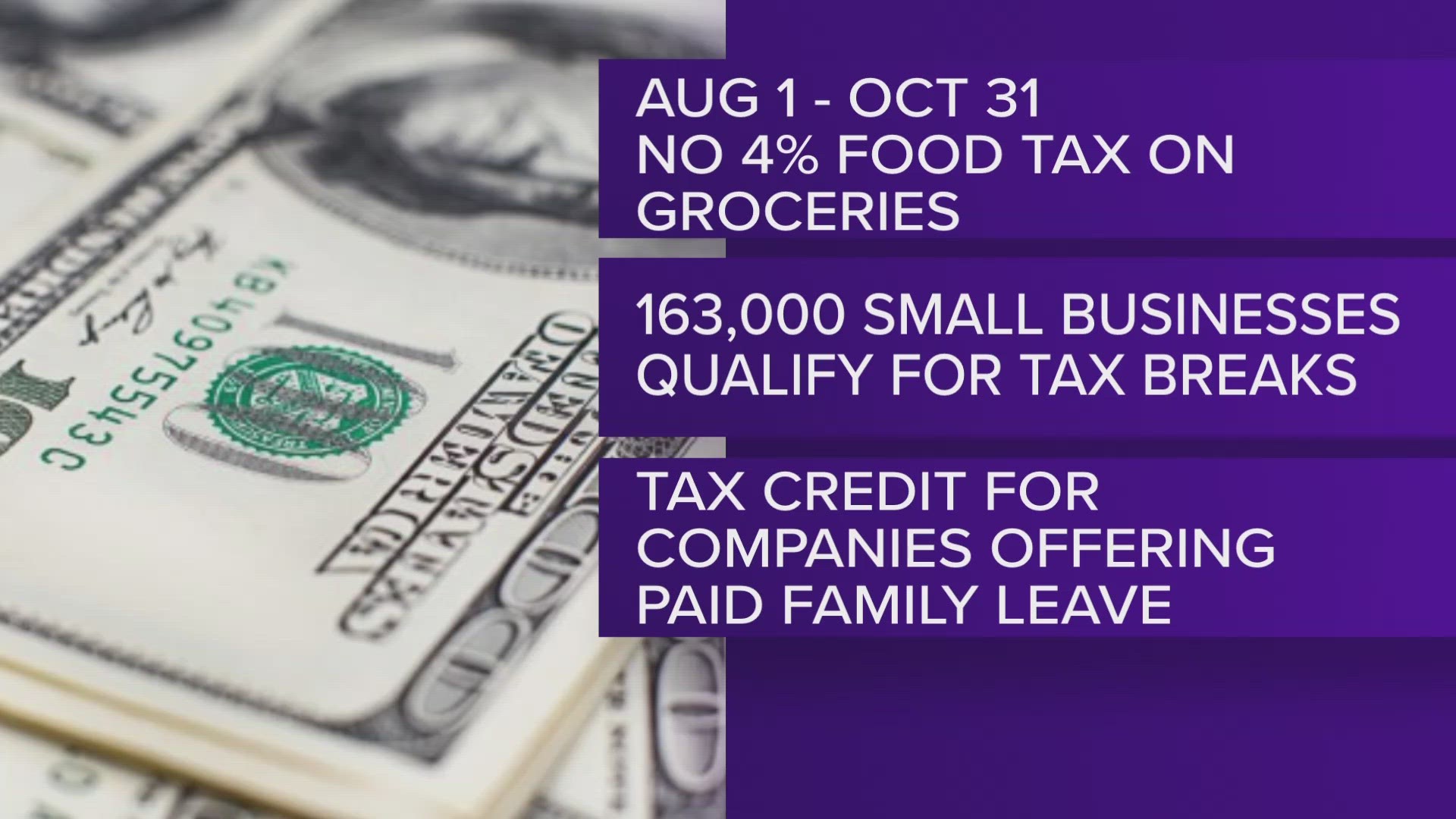

Those savings include a grocery tax suspension, tax breaks for small businesses, and cost recovery and incentives.

Savings in the grocery store

The tax act sets aside $273 million alone to include a three-month grocery tax suspension. The grocery tax suspension will begin on August 1 and end on October 31.

Tax breaks for small businesses

Small businesses will receive a total of $150 million in annual tax relief. To free up available money for businesses, the bill excludes first $500,000 in property investment from franchise tax.

It also increases the exemption threshold for business tax, making more businesses eligible for tax breaks. The act also makes first $50,000 of a business' net income exempt from excise tax.

Business cost recovery

The new legislation also simplifies tax administration, allocating $64 million to adjust to the federal bonus depreciation provisions given in the 2017 Tax Cuts & Jobs Act.

Gov. Lee said conforming with federal bonus depreciation provisions will help businesses recover costs faster and promote investment in Tennessee production

According to Gov. Lee, the state's frugal spending made the tax cut act possible.

“Tennessee’s legacy of responsible fiscal stewardship has allowed our state to weather national economic storms while maintaining a balanced budget and cutting taxes for Tennesseans,” Gov. Lee said.